How to Send Money from Canada to the Philippines

24 October 2024

Are you looking for the best way to send money from Canada to the Philippines? We know how important it is to choose a secure, fast, and convenient service. Discover how OTT Remit can provide an easy and reliable solution to help you send more money home.

Send Money from Canada to the Philippines with OTT Remit

Remittances play an important role in supporting Filipino families. It is a way for them to stay connected and to be able to provide for their loved ones even from miles away. With many Filipinos looking for reliable and secure ways to send money from Canada to the Philippines, we are inspired and motivated to support the financial needs of the community. We are committed to providing a service that offers a rewarding experience for all their money transfer needs.

Are you looking for the best way to send money from Canada to the Philippines?

We know how important it is to choose a secure, fast, and convenient service to send money from Canada to the Philippines. With OTT Remit, we aim to make every transaction a rewarding experience that adds value for our customers. From points that will help customers save on transaction fees to dedicated support when you need it, every transaction is meaningful.

Let us walk you through on how OTT Remit can provide an easy and reliable solution to help you send more money home.

How to Send Money from Canada to the Philippines with OTT Remit

If this is your first money transfer with OTT Remit, follow these steps to get started:

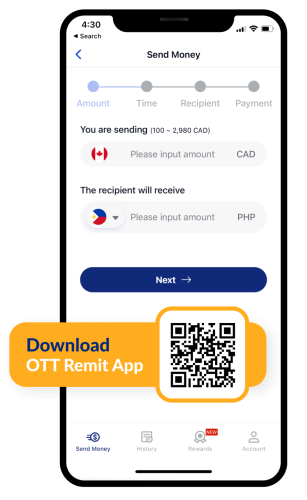

- Simply download the OTT Remit app or visit www.ottremit.com to sign up for an account using your phone number.

- Complete the required information in the online registration form to avoid delays in your money transfer.

Follow these quick and easy steps to send money:

- Select the currency, remit amount, money transfer delivery time and method to send

- Enter your recipient’s information.

- Pay for your money transfer by making an INTERAC e-Transfer.

How to Send Money from Canada to the Philippines Using OTT Remit and GCash

Follow these steps to send money from Canada to a GCash mobile wallet in the Philippines using OTT Remit:

- First, make sure you have an OTT Remit account to log in to or sign up in the OTT Remit app or www.ottremit.com.

- Next, enter the amount to be sent, choose delivery time, and select E-Wallet-GCash.

- Then, provide the recipient’s name (must match GCash account), address and GCash mobile number.

- After confirming that the details are correct, you can complete transaction via Interac email transfer

Frequently Asked Questions About How To Send Money from Canada to the Philippines with OTT Remit

How much does it cost to send money from Canada to the Philippines?

You can view the exact transfer fees at the time of sending. If you are a new user, the first two transfers are $0 CAD transaction fee*. *Fees are waived when points are used

How can I track the status of my money transfer?

Tracking your money transfer is simple and accessible and will allow you to send money home with confidence. Once logged in to your account, go to the history page at the bottom of the navigation bar to view all your transactions. Just click on the transaction that you want to monitor to see the transaction flow and details. For more information, please visit <link>

What should I do if my transaction is delayed?

If your transaction is delayed, please check your OTT Remit account or email for any update or notification about the transfer. Sometimes, delays due to banking hours, holidays, and weekends can affect processing times. For further assistance, you may call our customer support at (1) 416238-7869 or email us at support@ott.ca.

Ready to Send Money to Canada from the Philippines?

OTT Remit makes it simple and affordable to send money from Canada to the Philippines. Sign up now for free and enjoy $0 CAD transfer fee* for the first two transactions! *New customers only. Transaction fees are waived when points are used.

Disclaimer: The views and opinions expressed by the authors in this publication are their own and do not necessarily reflect the views of OTT Remit, OTT Financial Inc., and the OTT Group of Companies. This publication is provided for general information purposes only and should not be considered as exhaustive or comprehensive in covering all aspects of the discussed topics. It is not intended to replace seeking advice from a specialist or professional.