Are Remittance Services Safe?

How You Can Safely Send Money to Loved Ones

22 November 2024

Discover tips for choosing a reputable remittance service, protecting your personal information, tracking transactions, and ensuring safe transfers with trusted providers like OTT Remit.

Sending money to loved ones abroad is an important service that millions of people depend on as a way to show support and stay connected. The money that you send is able to support a family, pay bills, or manage obligations highlighting just how important it is to make sure that your money transfers are safe and secure. But are remittances safe? The short answer: Yes, if you choose the right service and follow recommended practices. Here’s a guide on how to send money securely with remittance services.

Why Safety Matters in Remittances

The worldwide remittance sector moves billions of dollars every year, making it a prime target for fraudsters and cybercriminals looking to exploit unsuspecting users. Sending money internationally often involves sensitive personal and financial information, which can be at risk if proper precautions are not taken. For this reason, safety and security are paramount when transferring funds to ensure that your hard-earned money reaches your intended recipient without complications.

By using trusted and regulated platforms, practicing good digital hygiene, and staying alert to potential scams, senders can significantly reduce the risk of fraud. Features such as encrypted transactions, secure authentication processes, and real-time tracking help protect both the sender and the recipient. Additionally, reputable remittance providers implement strict anti-money laundering and compliance measures, further safeguarding the transfer process.

Ultimately, prioritizing safety in remittances is not just about protecting money—it’s about ensuring peace of mind for both you and your loved ones. When security is maintained at every step, families can focus on what matters most: supporting each other, maintaining connections across borders, and enjoying the benefits of a reliable, hassle-free transfer experience.

Here’s what you need to do to make a safe and secure money transfers:

1. Choose a Reputable Remittance Service

When choosing a remittance service, it’s important to know that your money is being handled by a trusted provider. In Canada, All money services businesses (MSBs) must fulfill specific obligations as required by the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) and associated Regulations. these measures are in place to help combat money laundering and terrorist activity financing, to make sure that your transactions are safe.

- Ensure the company is licensed to operate in your country and regulated by relevant financial authorities.

- Positive customer reviews can give you an idea of the reliability of the service.

- Trusted services, like OTT Remit, partner with recognized banks or financial platforms like GCash, to ensure smooth and safe transactions.

When you choose a reputable provider like OTT Remit, you’re prioritizing safety and peace of mind.

2. Protect Your Personal Information

Your personal and financial details are essential for processing any remittance, but they can also be prime targets for fraudsters. Protecting this information is the first and most important step to ensure a safe transfer. Avoid sharing sensitive information like your account numbers, passwords, or OTPs (one-time passwords) with anyone. Always use secure and reputable platforms, like OTT Remit, which use encryption and other security measures to safeguard your data. Be cautious of phishing attempts, suspicious emails, and phone calls that ask for your personal details, and double-check URLs before entering any information online.

Here are some ways you can protect your information to avoid scams:

- Never share sensitive information like passwords or PINs.

- Double-check URLs and email addresses to avoid phishing scams.

3. Track Your Transactions

Once you’ve sent money, it’s important to monitor the transfer until it reaches the recipient. Many platforms, including OTT Remit, provide the option to track your transactions in real-time. You can view important details such as the delivery method, sender and recipient names, transfer status, and estimated arrival time. Keeping a digital or printed copy of the transaction receipt can also be helpful for your records and in case any issues arise.

Tracking your transaction not only ensures transparency but also gives peace of mind, as you can see exactly where your money is at every step of the process. This reduces anxiety about whether the funds have been successfully delivered and allows you to address any potential delays or errors promptly. By protecting your information and actively monitoring your transfers, you can significantly reduce the risk of fraud and ensure that your money reaches your loved ones safely and securely.

4. Know Your Recipient's Details

Only send money to trusted friends and family. And to avoid delays in your money transfer, make sure to give the complete information of the recipient. Always confirm the following:

- Full name (as it appears on their ID).

- Correct account or wallet details.

Sending Money Safely

Remittances are safe as long as you take the right precautions and choose a reliable, trustworthy service. By being vigilant, protecting your personal and financial information, and following the steps outlined in this guide, you can significantly reduce the risk of fraud and ensure that your hard-earned money reaches your loved ones quickly and safely. Using a regulated and well-established provider adds another layer of security, giving you confidence that every transaction is monitored, encrypted, and compliant with international financial standards.

Taking the time to double-check recipient details, track your transfers, and keep records of your transactions further ensures transparency and peace of mind. These precautions help prevent errors, delays, or unauthorized access, making the remittance process smooth and worry-free.

Ready to send money securely and confidently? OTT Remit offers a fast, affordable, and reliable way to send funds to your loved ones, combining cutting-edge technology with user-friendly features. Whether it’s supporting family, paying bills, or sending gifts, OTT Remit makes it easier than ever to transfer money internationally while keeping your funds protected every step of the way. By choosing a trusted service like OTT Remit, you can focus on what matters most—caring for your family and connecting with loved ones across the globe—without worrying about the safety of your transfers.

What documents do I need to send money securely through OTT Remit?

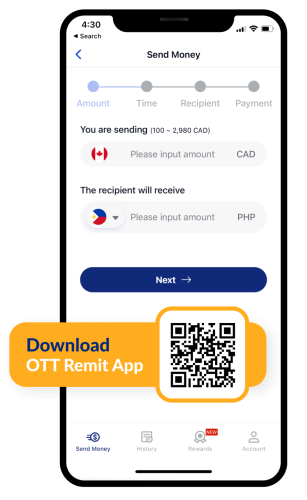

To send money with OTT Remit, you must sign up with complete information as it appears on your government-issued ID. For added convenience, you can verify your ID to enjoy faster transaction processing and send remittances up to CAD 2,980. It also ensures your transactions are safe and secure.

How can I track my remittance with OTT Remit?

OTT Remit offers real-time tracking for all transactions. Once you send money, you can monitor its status through your account, ensuring transparency and peace of mind.

What should I do if I notice an error in my recipient's details?

If you notice any mistakes in the recipient’s details after sending money, contact OTT Remit’s customer service immediately. They can assist in correcting the issue, depending on the transaction status.

Disclaimer: The views and opinions expressed by the authors in this publication are their own and do not necessarily reflect the views of OTT Remit, OTT Financial Inc., and the OTT Group of Companies. This publication is provided for general information purposes only and should not be considered as exhaustive or comprehensive in covering all aspects of the discussed topics. It is not intended to replace seeking advice from a specialist or professional.