What Does Remittance Mean?

Defining Remit & Tips on Sending Money

4 November 2024

This comprehensive guide will dive into the meaning of remit, the impact remittance has on Filipinos, and ways to send remittance effectively and safely using OTT Remit.

Remit: Definition & Meaning – Tips on Sending Money from the Philippines to Canada Using OTT Remit

Sending remittances plays a vital role for families overseas. Countries such as the Philippines, China and India are sent billions of dollars in remittances from loved ones in Canada every year. In 2023, over 1 billion USD of remittance was sent over by Overseas Filipino Works (OFWs) to their loved ones in the Philippines alone. The funds sent through remittances helps families several ways – from providing basic needs (like groceries, healthcare, and everyday expenses) to funding education and investments. In the case of the Philippines, not only do individual families rely on the income that comes with remittance, but the country’s entire economy depends on it.

For many, remittance is more than just a simple transaction: it is a means of support and a bridge connecting families separated by distance. But exactly what is remittance? What does remittance mean? How does it impact Filipinos and their families? And what are the most efficient and secure ways to remit funds from the Philippines to Canada?

This comprehensive guide will dive into the meaning of remit, the impact remittance has on Filipinos, and ways to send remittance effectively and safely using OTT Remit.

What Does Remittance Mean?

In layman’s terms, the meaning of remit is the act of sending money to someone. The term remittance can be understood as either the sum of money transferred, or the act itself. However, the concept of remittance goes beyond its literal definition.

What Does Remittance Mean to Families Overseas?

For those that work overseas, to send remittance it to send funds to family and friends back home. Receiving remittance can range from the ability to afford the basic necessities, to the ability to pay for education and investments. The meaning of remittance and its significance can range from crucial as the family’s sole income, received as a supplemental income so families aren’t struggling as the working poor, or one-time transfers for emergencies or special occasions. Regardless of the significance the monetary amount holds to those receiving, remittance is driven by the sender’s sense of duty, love and support for their loved ones.

The Importance of Remittance to Filipinos

Working abroad, to be an Overseas Filipino Worker (OFW), is a common profession in the Philippines. In fact, mass Filipino labor migration has been in practice as early as the 16th century with the movement of native Filipinos to work as laborers in Acapulco. The recent resurgence of OFWs stems from the 1970s when workers left for the Middle East to work on oil rigs and construction sites, and again throughout the 1980s and 90s to fill domestic and caregiving roles throughout the West. This recent diaspora, however, is due to a lack of employment opportunities in the country, compelling family members to look elsewhere for work in order to provide for their families.

That being said, the driving force behind the Filipino labor migration is to send remittance back home to families, to provide an income that betters the lives of their loved ones. For Filipinos, the meaning of remit holds significant value as a lifeline. Many Filipino families depend on remittances sent by relatives working in countries like Canada. And for the Philippines, remittance doesn’t just significantly impact the lives of individual families, but the country as well. In 2023, remittances from OFWs contributed a whopping 8.5% of the country’s Gross Domestic Product (GDP), and 7.7% of the country’s Gross National Income (GNI).

Given this importance, Filipinos often seek reliable ways to send money, whether through banks, apps, or dedicated remittance services like OTT Remit.

Ensuring Safe & Efficient Transactions

A number of factors come to mind when considering remittance: this includes the speed the funds are transferred, the security of the transfer, and the fees involved. Understanding the meaning of remit and the remittance process can make sending funds less stressful for new-timers and more convenient for veterans. It is also important to ensure that the platform you use to send remittances complies with local and international regulations – to protect both the sender and the recipient.

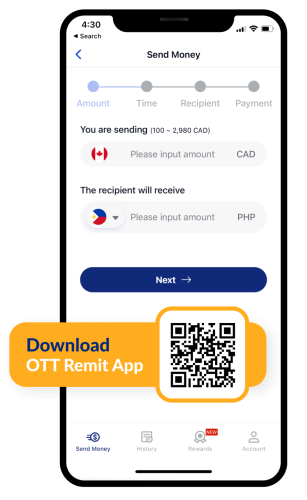

With the rising innovations to digital banking and online payment platforms, sending money to countries, like the Philippines, has become a lot more seamless compared to 20 years ago. There are even apps, like OTT Remit, catered solely to send remittances and offer hassle-free online transfers.

The Best Way to Send Money Abroad

Selecting the best way to send money abroad can depend on many factors, including the convenience for the sender and the needs of the recipient. Although traditional methods – like bank wire transfers – are still popular, digital platforms can offer unique benefits to both the sender and the recipient.

Here are some of the best ways to send money abroad:

- Bank Transfers — Bank transfers are the tried-and-true way of sending money. Widely used and generally secure, bank transfers are still one of the reigning ways to send money. However, bank transfers are slower and incur higher fees than digital alternatives.

- Remittance Services — Remittance services are alternatives to bank wire transfers that specify in sending money back home. OTT Remit, for instance, is a platform tailored to offer secure, fast, and low-fee transfers, making it the best way to send money abroad. Using OTT Remit ensures peace of mind with real-time tracking and efficient customer support.

- Mobile Apps — Digital remittance apps are the most innovative way to send money. With remittance apps like OTT Remit, users can send money instantly, avoiding long bank queues and in the comfort of their own home.

- Cash Pickups — Cash Pickup services allow recipients to collect their remittances in cash from a designated location. Cash Pickups are useful when the recipient doesn’t have a bank account, a smartphone, or just prefers to use cash. However, these platforms generally tend to have higher fees than the other platforms.

- E-Wallet Services — E-Wallet services allow uses to send and receive money online, voiding physical cash or cards. They’re convenient and cost effective, however, and acceptance may be limited.

How to Securely Send Money Online

Some things to consider when sending money over from the Philippines to Canada online:

- Choose the Right Remittance Services — Choosing the right remittance service includes doing some research beforehand. Consider the speed the funds are transferred, the security of the transfer, the fees involved, and the accessibility and convenience of the platform.

For instance, OTT Remit offers a user-friendly app that includes seamless transactions, high security, low fees, supports various payment methods, and a beneficial rewards program. - Provide Accurate Information — When filling out form fields, make sure the information you provide is correct and up-to-date – even double and triple checking your information is recommended. Incorrect information can delay your transaction and postpone funds from reaching your loved ones.

- Consider the Best Time for Transfers — Exchange rates fluctuate often, so it’s important to be mindful of the timing of your remittance. The Philippine peso, for instance, is weaker compared to the Canadian dollar, so you would want to maximize the value of your remittance – especially for large transactions.

- Use Remittance Advice — Remittance advice is a document that confirms the payment and confirms that your payment is on its way. It contains the details of the transaction and helps both the sender and the recipient track the remittance and resolve any issues that may arise during the transfer.

Final Thoughts on The Meaning of Remit

Answering questions like “What is Remittance?”, realizing the meaning of remit, how it impacts families, and choosing the best way to send money abroad, ensures that your loved ones receive the financial support they need.

For Filipinos, knowing how to reliably send money from Canada to back home provides peace of mind. Remittance services like OTT Remit is able to provide that peace of mind by establishing safe, efficient, and cost effective ways to transfer money. We know that remittance is more than just a transaction — it is a means of supporting and connecting families, no matter the distance.

Whether you are new to remittances or experienced, selecting a reputable service can make all the difference. Keep this guide in mind as you navigate how to send your remittance and continue to strengthen the bonds with those who matter most.

What is remittance and why is it important?

The meaning of remit is the act of sending money to someone. The term remittance can be understood as either the sum of money transferred, or the act itself. Remittance is important because it provides financial support for loved ones. For Filipinos, the funds have provided the necessities and more for families across the Philippines for generations.

How can I send money internationally?

Sending money internationally depends on the country, the remittance service, and the recipient’s needs. Using trusted remittance services like OTT Remit ensures that the transaction is secure and straightforward, especially for international transfers from the Philippines to Canada.

What is the best app to send money to someone?

OTT Remit’s mobile app is considered one of the best for Filipinos due to its ease of use, low fees, and fast transaction times. It is especially suitable for those looking to send money internationally with minimal hassle.

How do I send money from Canada to the Philippines?

The process of how to send money from Canada to the Philippines is simple with OTT Remit. By using our app or website, you can initiate transactions quickly, with multiple payout options for your recipient in the Philippines.

Disclaimer: The views and opinions expressed by the authors in this publication are their own and do not necessarily reflect the views of OTT Remit, OTT Financial Inc., and the OTT Group of Companies. This publication is provided for general information purposes only and should not be considered as exhaustive or comprehensive in covering all aspects of the discussed topics. It is not intended to replace seeking advice from a specialist or professional.