How to Send GCash from Canada with OTT Remit

24 October 2024

If you’re living in Canada and want to send money to the Philippines, OTT Remit offers a convenient and reliable option to send to GCash mobile wallet. GCash is one of the leading mobile wallets in the Philippines that allows your recipients to offers easily access the funds you send.

Expect a Quick Call After You Register for a Seamless Transaction!

Send Money with OTT Remit and GCash

If you’re living in Canada and want to send money to the Philippines, OTT Remit offers a convenient and reliable option to send to a GCash mobile wallet so that your recipients can easily access the funds you send. GCash is one of the leading mobile wallets in the Philippines that that only accepts Philippine pesos (PHP) as its default currency. To send your remittance directly to a GCash wallet, you will need to convert your funds to PHP by remitting it through any of their international remittance partners.

What Are the Advantages of Using GCash?

GCash makes it incredibly convenient for millions of Filipinos to handle their daily financial tasks with just a few taps on their smartphones. By turning your phone into a digital wallet, GCash eliminates the need to line up at payment centers or banks, saving both time and effort while giving users greater financial independence and flexibility. With GCash, your loved ones can pay bills, transfer money, save, purchase load, shop online, and even invest—all from the comfort of their home or while on the go.

Recipients who receive their funds directly into their GCash accounts enjoy instant access to their money, which means they can manage expenses more efficiently and accomplish more in less time. This is especially helpful for those who juggle multiple responsibilities, such as paying utilities, buying groceries, or sending allowances to family members. The platform also offers features like GSave and GInvest, allowing users to grow their money or start their investment journey without the need for a traditional bank account.

Security is another key advantage, as GCash uses advanced encryption and verification measures to protect every transaction. Plus, with thousands of partner merchants nationwide, it’s easy to use GCash for everything from paying for public transportation to shopping in malls. Whether it’s for everyday essentials, supporting loved ones back home, or planning for the future, GCash empowers Filipinos to take full control of their finances in a safe, fast, and hassle-free way.

OTT Remit and GCash Partnership

OTT Remit, a trusted international remittance partner, offers a seamless and secure way to send money to GCash, ensuring that your loved ones receive the funds quickly and without the usual hassle of traditional remittance methods. With this partnership, sending money from Canada to the Philippines has never been easier or more convenient. Whether you are supporting family, helping with daily expenses, or sending gifts, OTT Remit allows you to transfer funds directly to GCash accounts with just a few taps, eliminating the need for long queues, paperwork, or complicated banking processes.

This service is designed with both speed and security in mind. Transfers are processed efficiently, giving recipients almost immediate access to the funds in their GCash wallets, so they can pay bills, shop, or manage their finances without delay. Additionally, OTT Remit’s intuitive platform provides transparency and reliability, so senders can track their transfers every step of the way. This partnership not only makes financial support more accessible but also empowers families to stay connected and take care of each other, even across continents.

By combining OTT Remit’s trusted remittance network with GCash’s versatile digital wallet, Canadians sending money to the Philippines can experience a modern, frictionless approach to remittance—bringing loved ones closer and ensuring that funds are delivered safely, securely, and instantly.

Get Started with an OTT Remit account

To start sending money to GCash, you will first need to create an account with OTT Remit. If you haven’t already, it’s just a few simple steps that can be done online.

- Simply download the OTT Remit app or visit www.ottremit.com to get started.

- When creating your account, make sure that the required information is complete in the online registration form to avoid delays in transaction.

- You will also have the option to verify your ID in advance for a seamless transaction.

How to Send Money to the Philippines Using OTT Remit and GCash

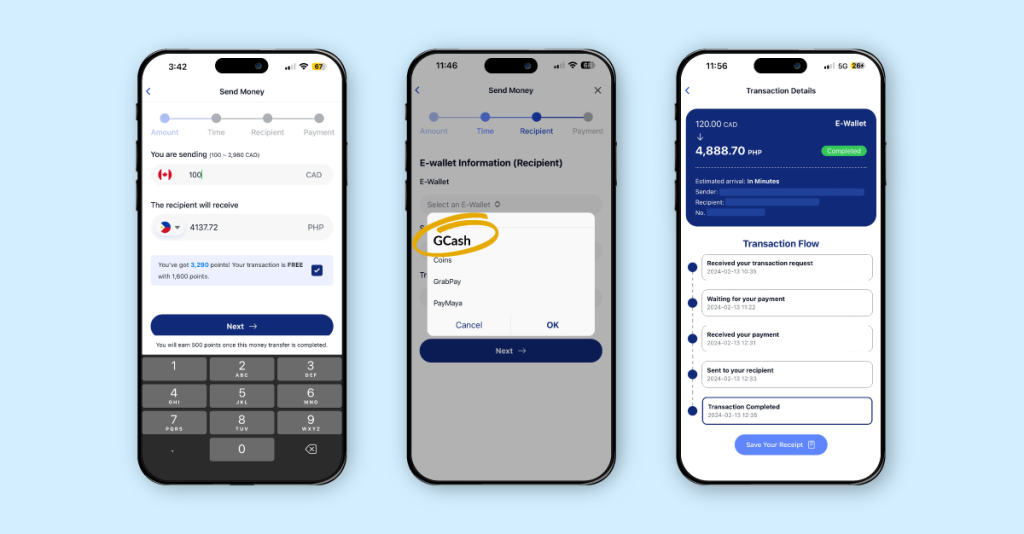

Once you’ve set up your OT Remit account, sending money to GCash is quick and simple.

- First, make sure you have an OTT Remit account to log in to or sign up in the OTT Remit app or www.ottremit.com.

- Next, enter the amount to be sent, choose delivery time, and select E-Wallet-GCash.

- Then, provide the recipient’s name (must match GCash account), address and GCash mobile number.

- After confirming that the details are correct, you can complete transaction via Interac email transfer

- Once transfer is completed, you may view the status of transaction in your OTT Remit account’s Transaction History

Ready to Send Money to the Philippines?

Using GCash to send money to the Philippines is easy and rewarding. We are here to make sure that your transfers are secure, affordable, and efficient, whether you’re supporting your family or helping a friend. New customers will also get $0 CAD fee* on the first two transfers when you sign up for free today! *Transaction fees are waived when points are used.

For more information, please visit our FAQs or call us at 1(416) 238-7869. We offer personalized support in Tagalog and English to assist you with any questions or concerns. Our dedicated customer service team is here to help you every step of the way.

To learn more about our partnership with GCash, check out the full article here.

Disclaimer: The views and opinions expressed by the authors in this publication are their own and do not necessarily reflect the views of OTT Remit, OTT Financial Inc., and the OTT Group of Companies. This publication is provided for general information purposes only and should not be considered as exhaustive or comprehensive in covering all aspects of the discussed topics. It is not intended to replace seeking advice from a specialist or professional.